IRMSA Risk Competency Assessment Tool (R-CAT)

Congratulations on choosing to embark on a journey of lifelong learning and professional development through the R-CAT.

Purpose

The IRMSA Risk Competency Assessment Tool is a tool that allows risk stakeholders to evaluate their skills and knowledge against industry standards. It serves to identify both strengths and areas for development, providing valuable insights that inform targeted learning, professional development, and growth initiatives.

The tool is divided into two competency development pathways, IRMSA Certification (Certified Risk Management Practitioner or Certified Risk Management Professional) and Personal & Career Development.

Risk Competency Categories explained

The IRMSA Risk Competency Model equips professionals to make informed decisions, show measurable growth, and strengthen organisational resilience and sustainability. Built on international standards and benchmarking, it provides a framework for continuous learning and skill relevance in an evolving risk landscape.

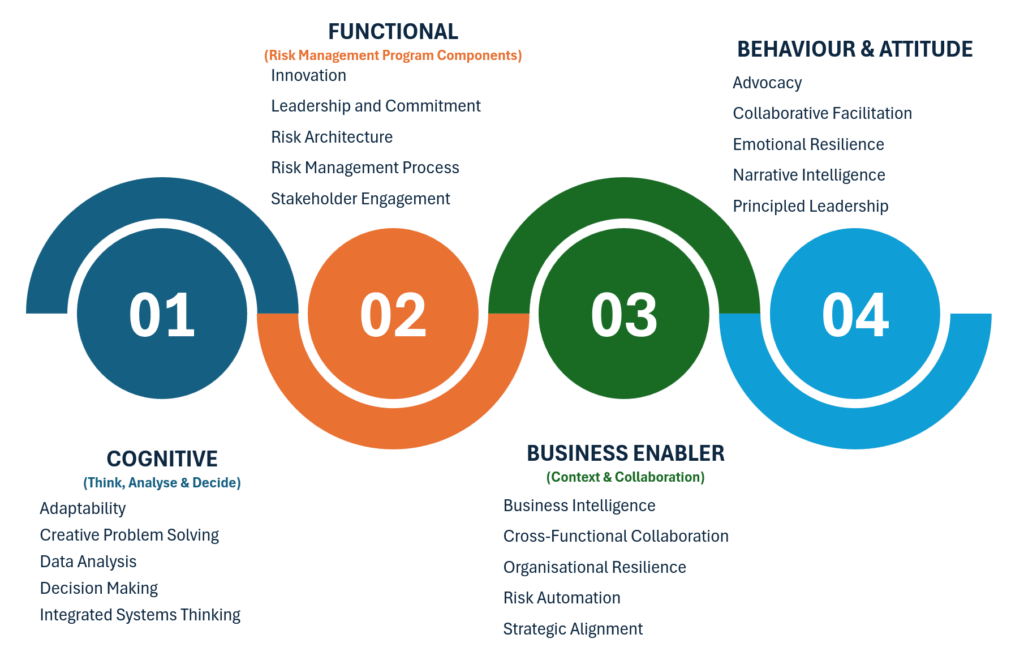

The IRMSA Risk Competency Model comprises 4 primary categories and 5 competencies per category:

Cognitive Competency:

A set of mental abilities and skills that help risk stakeholders acquire, process, and use knowledge effectively. These competencies cover thinking, problem-solving, and information processing, supporting learning, adaptation, and success in education, work, and daily life.

Functional Competency:

The specific skills, knowledge, and abilities that individuals or organisations possess and use to execute the risk management program effectively.

Business Enabler Competency:

The ability of individuals, teams, or organisations to effectively collaborate and integrate expertise and skills from various functional areas to identify, assess, mitigate, and capitalise on risks and opportunities.

Behaviour and Attitude Competency:

A set of skills enabling individuals and organisations to effectively handle social and interpersonal challenges or opportunities. These competencies are essential for managing the human and social factors that influence outcomes for people and groups.

The diagram below outlines the specific competencies associated with each risk competency category, providing a clear framework for evaluating proficiency across all key areas of risk management.

Risk Competency Proficiency (Skills, Knowledge & Ability) Levels explained

The table below outlines the various proficiency levels that serve as the foundation for the competency self-assessment.

IRMSA R-CAT Process Steps

Please follow the below steps to complete the assessment:

Step 1: Select Type

Select the type of risk competency self-assessment, i.e. IRMSA Certification or Individual Growth

Step 2: Desired Competency Rating

Complete the DESIRED competency rating, i.e.

For Certified Risk Management Practitioner Select 3 – Advanced

For Certified Risk Management Professional Select 4 – Expert

For Personal & Career Development Select 1 – Beginner or 2 – Intermediary or 3 – Advanced or 4 – Expert or 5 – Master

Step 3: Self Assessment Competency Rating

Perform the Competency SELF ASSESSMENT by selecting

1 – Beginner or

2 – Intermediary or

3 – Advanced or

4 – Expert or

5 – Master

GET STARTED WITH YOUR RISK COMPETENCY SELF ASSESSMENT

Select the TYPE of Risk Competency Self-Assessment